Judah Spinner

Government Debt Reduction Initiative

⭐ The Problem

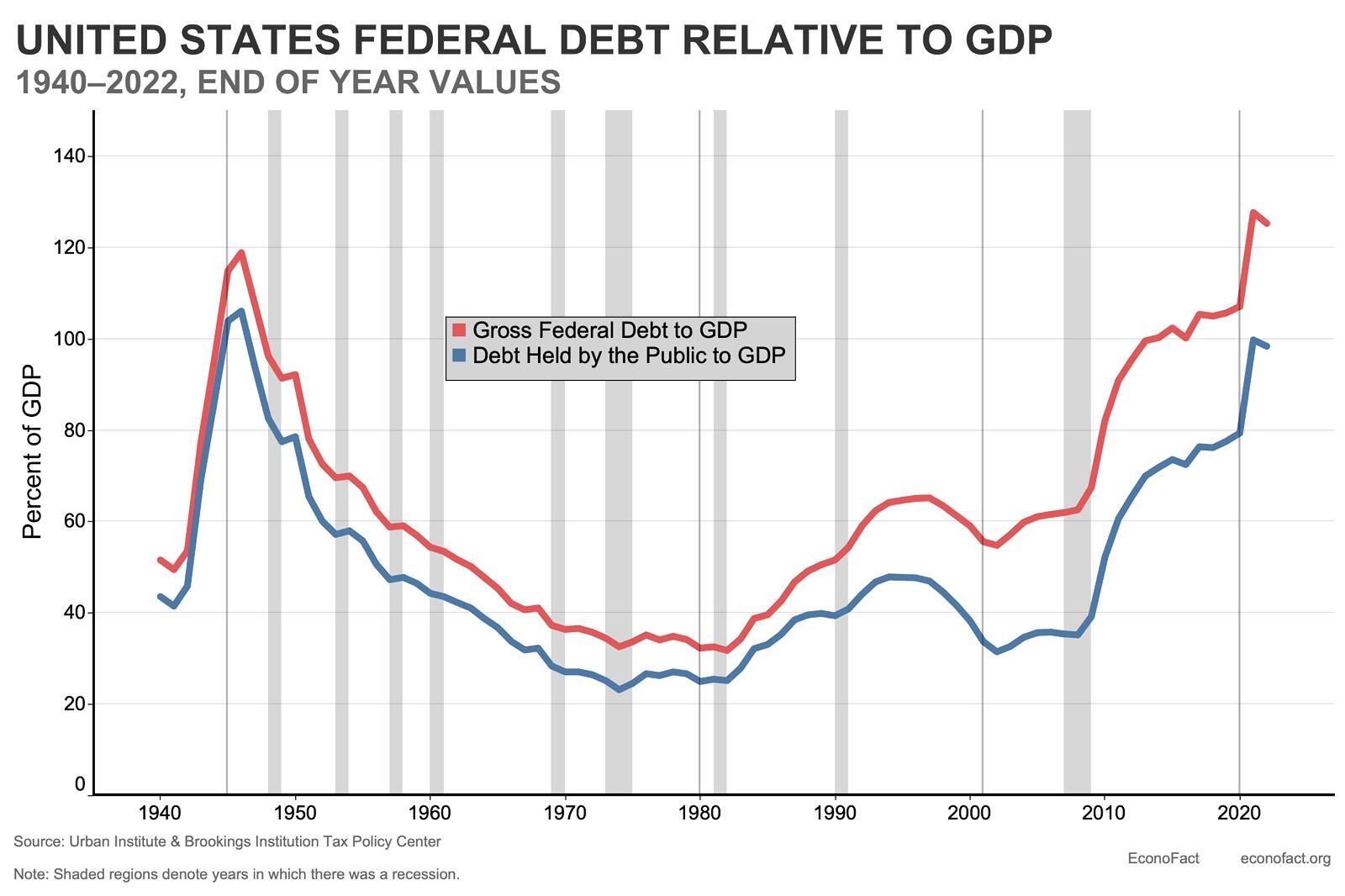

Since the turn of the century, the United States has consistently spent significantly more than it collects in revenue, contributing to the rapid accumulation of national debt. Large structural deficits have become the norm rather than the exception, driven by a combination of expanding entitlement programs, rising interest costs, and repeated emergency spending that was never meaningfully unwound once the crisis passed.

Recently, the U.S. national debt surpassed $38 trillion, reaching levels not seen since the end of World War II. Unlike that era, when wartime borrowing was followed by decades of fiscal discipline, strong growth, and deliberate debt reduction, today’s borrowing is occurring during peacetime and economic expansion. Even in years of low unemployment and solid GDP growth, deficits remain historically large.

The debt problem is one of those issues that seems invisible until it’s too late. It compounds quietly in the background, numbed by familiarity and political avoidance. Then, seemingly all at once, higher interest rates, slower growth, or a loss of confidence force painful choices. We are moving toward that cliff, and most of the public, and many policymakers, do not yet grasp the severity of this situation.

Key Statistics

Debt-to-GDP Ratio

120%

Interest Payments (Annual)

$1 Trillion

Debt Increase (Daily)

$5 Billion

Our Mission

We exist to help reduce the Government deficit to less than 3% of Gross Domestic Product

💡 Our Solution

1. Controlling Federal Expenditures:

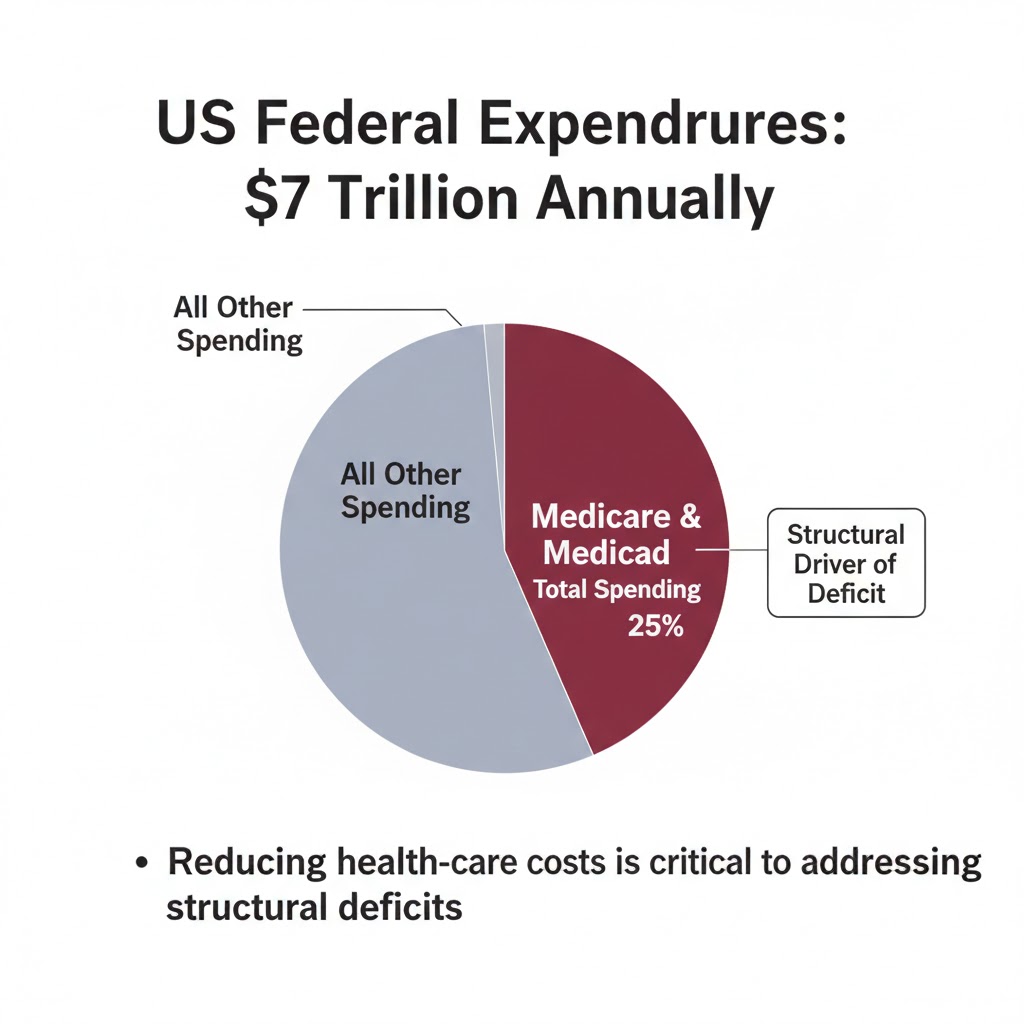

The foundation believes the federal deficit cannot be sustainably reduced without tackling its structural drivers, chief among them, runaway health-care costs. Federal spending in absolute terms is currently near or above $7 trillion annually. Medicare and Medicaid together account for more than 25% of this outlay. The foundation believes that meaningfully slowing the growth of federal expenditures, including through a reduction in health-care costs, is a critical part of addressing structural deficits. Reducing the cost curve in health care, for instance, would lower both Medicaid and Medicare outlays, which together represent a substantial share of federal spending.

2. Increasing Federal Revenues:

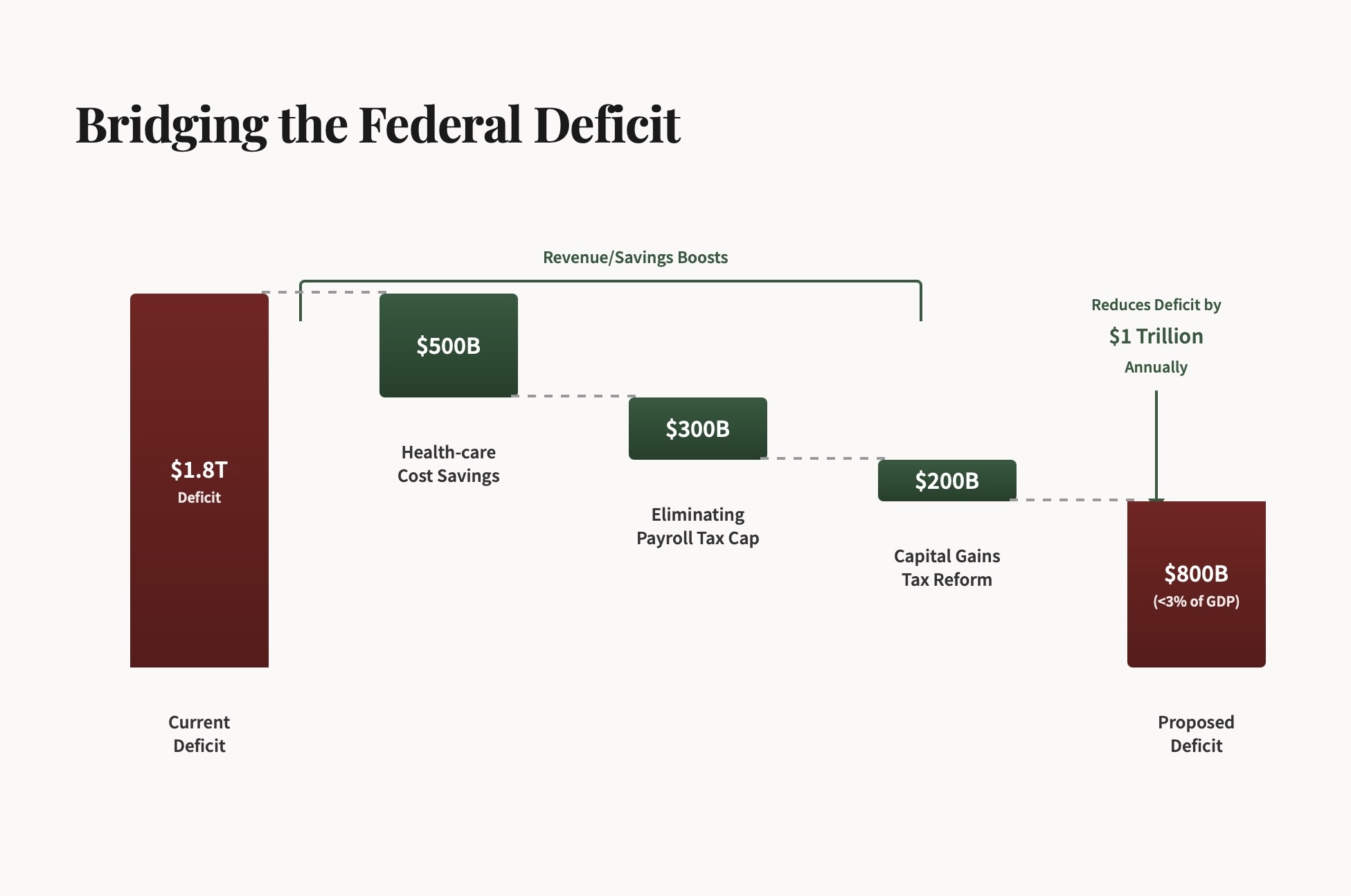

Revenue collections lag behind expenditures by a wide margin. Total federal receipts in recent years have been in the $5 trillion range, creating a structural shortfall. To help bridge this gap, the foundation supports sensible improvements to the tax code, including:

-

Eliminating the cap on payroll taxes. The current payroll tax cap exempts high earnings above a set threshold from Social Security contributions. Eliminating or raising this cap would broaden the base of taxable earnings and strengthen revenue inflows.

-

Reexamining preferential tax treatment of capital gains. Taxing investment income in line with ordinary income, particularly for high-income taxpayers, would increase government revenue.

If these changes are implemented, the federal deficit would decrease by more than $1 trillion annually, and would bring the deficit below 3% of GDP. With nominal GDP growing at over 4%, that shift would begin lowering the debt-to-GDP ratio, averting a potential fiscal crisis.